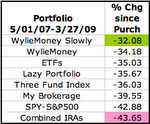

Arrrrggghhhh. MONEY

On this site I have put together a pretty detailed hypothetical portfolio available for purchase through Etrade. I have not gone into great detail about if I would actually buy these funds if I could or if I own any of them. MONEY

I do own some of them but I do not own all of them. Some of the categories I researched here, are categories for which I already own a Mutual Fund that I bought years ago. Even though the fund I picked for this hypothetical portfolio might look a little better than the fund I own, it is not worth it to me to sell my fund and pay the capital gains tax and then invest the leftover money in a new fund, at this point in time. Also I do not own funds for each of these 20 specific categories. MONEY

One of the funds I do own is SSGA Emerging Markets SSEMX. I bought it back in May of 2006. I have also managed to save enough to add $100 to my initial investment at a couple of points since then (not every month though!). Since I bought it, my holdings in this fund have increased 27.46%! Not bad for one year. MONEY

This is a risky fund and that risk has been well rewarded over the short term. I imagine it is only a matter of time before Putin does something so un-democratic that western investors balk and sell Gazprom in droves or China's speculators finally try and jump ship or Chavez convinces the rest of South America to 'reclaim' their private businesses. I do not know what it will be, but something will send emerging markets into a downturn. MONEY

In fact, yesterday, SSEMX was my second biggest loser down -2.03%. My biggest loser, if you're curious, was PNRZX. If you click that link, you'll see that PNRZX has been on fire over the last 5 years. I personally have only gained 10.30% since buying in just over a year ago. Not too bad, but not great given the recent gains I missed out on. My only fund that increased in value yesterday was BTTRX, a WylieMoney pick, up 0.14% on the day. MONEY

Even though I do not think it necessarily the best time to buy an emerging market fund specifically, I did try and add another $100 to my holding several days ago and was denied.

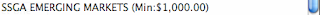

The entire reason I bought this specific fund and recommended each of the WylieMoney funds over sometimes better funds in each category is the $100 minimum for additional investments. I am still trying to figure out what happened here, but the last time I added $100 to this fund was in February. Now the minimum that Etrade is letting me add to my holding is $1000. So something changed in the last few months. Despite trying to save and invest as much as I can, I cannot afford to add $1000. And I should not have to darn it! Here is what Morningstar claims the fund allows: MONEY

What I suspect happened was that SSEMX changed its 'Additional Minimum Investment' to $1000 recently. You can see above it is $1000 now- I do not remember if it was that way before February. Fine. Gone are the days I can add $100 whenever I have the $100 to add and think the timing is right. I am willing to set up the Automatic Investment Plan or AIP for this. The Additional AIP minimum is listed as $100. MONEY

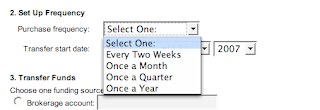

Etrade allows you to set up an AIP that invests in a few different intervals: MONEY

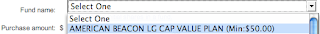

If I can come up with $400 a year to add to this fund, I could choose the "Quarterly" option and be all set, right? Not so fast! Here is a picture of the option I get when trying to set up the additional AIP investments: MONEY

So I called Etrade and here is what they tell me. Despite the fact that I already paid at least an initial $1000 when I first invested, to set up an AIP now, I have to pay another $1000 before I can reduce the AIP investments to $100. Since you can start and stop an AIP at anytime, this leaves me wondering if I should not have just bought the fund through this screen and set it up with an AIP plan for once a year that I never intended to make on that schedule and then just adjusted the frequency and amounts as desired. MONEY

But this does not make sense. I should not have to pay different amounts based on which screen I used to buy the fund. Does this make sense to anyone else? Do all brokerages and funds that have different minimums for AIPs and and non-AIP subsequent purchases make you pay a separate 'Initial Investment Amount' to both buy the fund initially and then set up the AIP as well? MONEY

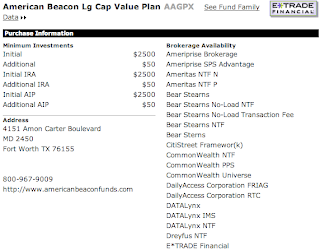

This is not what is going on at Etrade either, at least not consistently. Another WylieMoney recommended fund I own is American Beacon Large Cap Value Planahead AAGPX. Here are the details for this fund from Morningstar:

So to set up an AIP to automatically invest $50, I should have to first pay another $2500. But I don't. Here is my option in the drop down menu: MONEY

I'm going to try approaching Etrade again and see if I can find out more. MONEY

WYLIE MONEY SEARCH

MAVERICK MONEY MAKERS

If you are looking for a easy automated system, developed by millionaires, and proven to generate at least $354.97 per day from home, then Maverick Money Makers may be just what you're looking for!:click here for more information

If you are looking for a easy automated system, developed by millionaires, and proven to generate at least $354.97 per day from home, then Maverick Money Makers may be just what you're looking for!:click here for more information

Tuesday, April 14, 2009

Etrade, don't do this to me!

Posted by Healtyboy at 3:52 AM

Labels: Brokerage, Mutual Fund, Timing

Subscribe to:

Post Comments (Atom)

0 comments:

Post a Comment