WYLIE MONEY SEARCH

MAVERICK MONEY MAKERS

If you are looking for a easy automated system, developed by millionaires, and proven to generate at least $354.97 per day from home, then Maverick Money Makers may be just what you're looking for!:click here for more information

If you are looking for a easy automated system, developed by millionaires, and proven to generate at least $354.97 per day from home, then Maverick Money Makers may be just what you're looking for!:click here for more information

Tuesday, April 7, 2009

100% Goal Achieved for our Walk Team on Sunday!

0 comments Posted by Healtyboy at 10:03 AM

Labels: Giving

Saturday, April 4, 2009

The Real Scoop- Managed Funds, Index Funds or ETFs?

As promised, I have invested $50,000 in the Wylie Portfolio, $50,000 in a portfolio of Vanguard Index funds, $50,000 in a portfolio of ETFs, and $2500 in the first Wylie fund of the Wylie Portfolio. By first fund, I mean the first fund I picked: NTIAX. The extra $324.12 comes from fees required for the ETF portfolio and the exact cost of each ETF position being a little more or less than $2500.

So we have a portfolio of assorted managed funds and a few index funds you can buy through etrade for no fees, a portfolio of Vanguard index funds that you can't buy through Etrade or Vanguard for any fee because each fund has a $3000 minimum. I only invested $2500 to make the comparison simple. We have a portfolio of ETFs you can buy through Etrade for $12.99 each. And we have a version of the mostly managed portfolio I will add to one fund per month.

The purchase dates for all these portfolios is the price as of closing on 5/1/07. So if you have your own portfolio you want to compare to these, go to morningstar and create your own portfolio and enter your purchase at the price from 5/1/07. It is easy to look up historical prices. One way to do this is to go to Yahoo Finance and look up your fund or stock and click the "Historical Prices" link.

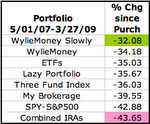

So far, the Wylie Portfolio invested in just one fund is in the lead, up 1.44% and the entire Wylie Portfolio of 20 funds is up 1.09% compared to the Vanguard Portfolio which is up 1.02% and the ETFs which are up .46%. Note that Year to Date, the Wylie Portfolio is in last place:

Some of the ETFs have not been in existence since 1/1/07 so I am not going to put too much creed in that figure as it is not an equal comparison. I'm also not going to put much creed in performance of two days. We'll see how things look in a bit.

Here are the portfolios. Click the image for a larger view:

0 comments Posted by Healtyboy at 9:50 PM

Labels: Investing, Mutual Fund, Non-Retirement

The Walk for Hunger is Sunday- Thanks again!

The Walk for Hunger is Sunday and I just want to say thanks again for the donations! I'm not sure if I'll hit my goal, but you have already contributed more than we have raised in the past so I'm excited!

I did not explain the walk very well and got some grief for it so here goes:

Last year about 43,000 of us did the walk.

The route is 20 miles long. It starts and stops in the Boston Common and goes out to Newton and back. I'll take some pictures and write about it next week!

I'll take some pictures and write about it next week!

0 comments Posted by Healtyboy at 9:50 PM

Labels: Giving

Non-Retirement: Inflation Protected Bond Mutual Fund

Wylie Pick: American Century Inflation Adjusted Bond inv ACITX

Selecting from mutual funds available through Etrade with no load or transaction fee and an initial $2500 investment or lower minimum and subsequent $100 or lower minimums, when looking for an inflation protected bond fund, I use the Mutual fund screener and find one.

Back in November of last year I started this project. This is the 20th fund and it is the last pick for this portfolio.

It looks pretty average all around. Expenses are a fairly low 0.49%. It gets three stars- average returns with average risk.

Actually if you look at it using Morningstar, it looks like it is slightly ahead of its category and its peers. Regardless, we are not talking about spectacular returns. Hopefully it will stay average. If this category performs really well, that will likely mean that inflation is out of control and that might be good for this fund, but the rest of the funds, not to mention the economy might be less amused.

So there is only one option, but it serves our need so ACITX is the pick!

0 comments Posted by Healtyboy at 9:49 PM

Labels: Mutual Fund, Non-Retirement

Monday, March 30, 2009

Non-Retirement: Foreign Large Cap Blend Mutual Fund

Wylie Pick: BlackRock International Index A MDIIX

Selecting from mutual funds available through Etrade with no load or transaction fee and an initial $2500 investment or lower minimum and subsequent $100 or lower minimums, when looking for another Foreign fund, I include all International Foreign Category Funds and use the Mutual fund screener to a number of options.

I was planning to choose a Foreign Small/Mid Cap Value fund to balance against the Foreign Small/Mid Cap Growth fund already selected. Sadly, there is only one available through Etrade to new investors and I do not like the looks of it.

ICON International Equity I IIQIX is listed as a Small/Mid Cap fund, but then is also listed (yes, both links go to the same page!) as a Large Cap Blend fund that recently changed from being a Large Cap Growth fund. The average market value of companies held by the fund is $15 billion. A small company fund this ain't. And it may be focused on value companies or growth or both. Now we could dive deeper into this and try and figure it out, but why bother...

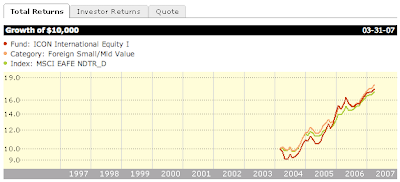

The expenses on this fund are 1.71% which is higher than any of the other Foreign funds across all categories. The turnover ratio was also higher than all other funds from this search and that is only acceptable if performance is stellar on a comparative basis and it is not. It has slightly out-performed one of the benchmarks it claims to track, but has underperformed the average of its peers in this group:

So instead of a Small/Mid Cap company fund I'll chose a Foreign Large Cap Blend fund to compliment the Foreign Growth and Value funds already in the portfolio and I'll ignore the ICON fund because of high expenses and turnover.

Among Blend funds we have 6 choices and really 2 choices that stand out. And upon further investigation, one of these two funds- SSgA International Stock Selection SSAIX is listed as a Blend fund but is also listed as a Value fund and has been a operating as a Value fund for many years. I already have a value fund so I am going with the other choice.

I'm starting to wonder if all of these category designations are being manipulated to represent performance in a better light than is legit. Funds are often measured against their peers, but if a fund is compared against peers in a category other than the one in which it invests, then the comparison is not really valid and perhaps fraudulent.

Anyway, BlackRock International Index A MDIIX is a foreign blend index fund. It has lower than average expenses (0.81%) and turnover (23%) which one expects with an index fund and has performed better than all the other legit Blend funds available over the last year.

0 comments Posted by Healtyboy at 6:00 PM

Labels: International, Mutual Fund, Non-Retirement