Wylie Pick: BlackRock International Index A MDIIX

Selecting from mutual funds available through Etrade with no load or transaction fee and an initial $2500 investment or lower minimum and subsequent $100 or lower minimums, when looking for another Foreign fund, I include all International Foreign Category Funds and use the Mutual fund screener to a number of options.

I was planning to choose a Foreign Small/Mid Cap Value fund to balance against the Foreign Small/Mid Cap Growth fund already selected. Sadly, there is only one available through Etrade to new investors and I do not like the looks of it.

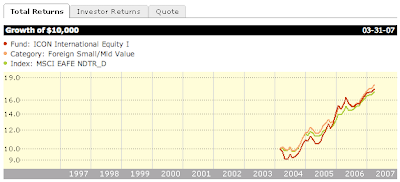

ICON International Equity I IIQIX is listed as a Small/Mid Cap fund, but then is also listed (yes, both links go to the same page!) as a Large Cap Blend fund that recently changed from being a Large Cap Growth fund. The average market value of companies held by the fund is $15 billion. A small company fund this ain't. And it may be focused on value companies or growth or both. Now we could dive deeper into this and try and figure it out, but why bother...

The expenses on this fund are 1.71% which is higher than any of the other Foreign funds across all categories. The turnover ratio was also higher than all other funds from this search and that is only acceptable if performance is stellar on a comparative basis and it is not. It has slightly out-performed one of the benchmarks it claims to track, but has underperformed the average of its peers in this group:

So instead of a Small/Mid Cap company fund I'll chose a Foreign Large Cap Blend fund to compliment the Foreign Growth and Value funds already in the portfolio and I'll ignore the ICON fund because of high expenses and turnover.

Among Blend funds we have 6 choices and really 2 choices that stand out. And upon further investigation, one of these two funds- SSgA International Stock Selection SSAIX is listed as a Blend fund but is also listed as a Value fund and has been a operating as a Value fund for many years. I already have a value fund so I am going with the other choice.

I'm starting to wonder if all of these category designations are being manipulated to represent performance in a better light than is legit. Funds are often measured against their peers, but if a fund is compared against peers in a category other than the one in which it invests, then the comparison is not really valid and perhaps fraudulent.

Anyway, BlackRock International Index A MDIIX is a foreign blend index fund. It has lower than average expenses (0.81%) and turnover (23%) which one expects with an index fund and has performed better than all the other legit Blend funds available over the last year.

WYLIE MONEY SEARCH

MAVERICK MONEY MAKERS

If you are looking for a easy automated system, developed by millionaires, and proven to generate at least $354.97 per day from home, then Maverick Money Makers may be just what you're looking for!:click here for more information

If you are looking for a easy automated system, developed by millionaires, and proven to generate at least $354.97 per day from home, then Maverick Money Makers may be just what you're looking for!:click here for more information

Monday, March 30, 2009

Non-Retirement: Foreign Large Cap Blend Mutual Fund

0 comments Posted by Healtyboy at 6:00 PM

Labels: International, Mutual Fund, Non-Retirement

When to buy Mutual Funds Part III

In Part I we pondered the issues involved in deciding when to invest. In Part II we looked at a few tools and discussed some strategies to help gauge what shape the market is in. In part III we will work out a system to invest in the wylie hypothetical portfolio of 20 mutual funds.

To make the initial investment in the 20 funds I am picking, I would need $50,000. Many of these funds have $2500 initial investments, so I plan to make a hypothetical initial investment of $2500 across the board to keep things simple. Hey- it is only hypothetical money, after all.

If I was investing my hypothetical $50,000 and it was mid to late 2002, I would invest it all right away. Indeed, in 2002, I did invest the savings I had set aside to invest, as soon as I was sure I could leave it invested for a while. I wish I had $50,000 real dollars to invest in a portfolio like this at that time as many of these funds are way up over the last 5 years.

That said, I do not think today is a terrible time to invest but also it does not feel like the best time either. So to invest my $50,000 hypothetical dollars, I will invest $2500 in one fund at a time, once every month. This will spread my initial investments out over almost two years.

I also plan to invest all $50,000 in a separate portfolio, right away and I will see after the fact which approach was better.

Once I make the minimum initial purchase for each fund I will add $100 to each fund or $2000 per month into the entire portfolio. And I will keep an eye on the market and the first day each month that markets are down about 1%, I will make that subsequent purchase. Etrade actually lets me do this for now. The $100 minimum for additional investment into mutual funds is often listed as being contingent on setting up an Automatic Purchase Plan, but I have found that I can pick the day myself and make the purchase manually for mutual funds I own (which again is not all 20 of these!).

I will invest these funds in two hypothetical portfolios in Morningstar's portfolio tool, unless I find a better one by next week.

Now some of you are saying- "I do not have $50,000 or $2000 extra a month to invest so what do I care" I tried to pick funds in a specific order such that one could invest any amount between $10k and $50k and still employ a system like this one. For example one could put $10,000 in a wylie portfolio of 4 funds. Then, if one could save $400 hypothetical dollars every month or every other month or even every quarter, one could still use this system- though there is no guarantee you won't lose gobs of money so do your own research and take responsibility for your own investments!

I'll try and work out how hypothetical portfolios of fewer funds perform as well.

Finally, I want to compare my list of Etrade's best no load no fee mutual funds (in my opinion!) against a similar portfolio consisting of Vanguard index funds and also against a portfolio of ETFs.

If all the work I did picking mutual funds does not lead to a portfolio that outperforms what could be easily done with simple index tracking, that will be good for me to know when I do have $50,000 real dollars saved up after I stick with all our tips for living cheaply!

So to do this, I need to finish picking the 20 funds. I hope to set up the portfolios starting in May so expect a few more posts soon!

0 comments Posted by Healtyboy at 5:59 PM

Labels: Investing, Mutual Fund, Non-Retirement, Timing

When to buy Mutual Funds Part II

In part I we discussed the difficulties involved in choosing when to invest. Now I will talk about a few strategies for timing investments in mutual funds. These strategies may be no better than reading the almanac or having a blindfolded monkey throw darts at a list of stocks. Regardless of whether these strategies are better than monkey darts, they provide me with an approach that takes the emotion out of the decision of when to invest which has its own value.

When everybody is selling and has been selling, it is often a good time to buy. Motley Fool wrote a nice article about this notion. Buying mutual funds on a dip is a little trickier than buying a stock on a dip. When you buy most mutual funds, you buy shares at the price of the fund as of 4 pm on the day you make the purchase. So if 3 pm comes around and the market category you are investing in is down 2% for the day, you can place a buy order and you will buy shares of a fund in that sector at a price close to 2% lower than had you bought them the day before. Of course the fund itself won’t be down 2% exactly unless it is an index fund, and even then it won’t be the exact same, but typically if the category is down, the fund will be down. Now there is nothing to say the market sector won't go down another 2% or more the next day, but if you are going to buy, buying at a slightly lower price than the day before seems like a good idea to me. My sense is that when sell-offs happen, momentum often drags good companies down with the bad so if your fund manager is making good picks and the value of the fund takes a hit from some panic selling it is a good time to buy.

Tip one: Invest on a dip.

Another concept is: money moves from sector to sector as certain kinds of companies go in and out of favor among traders. For the most part, I am not looking into ‘sectors’ with the hypothetical portfolio I am putting together on this site. Recently, Financial, Technology, and Health sectors have lagged behind Natural Resources, Utilities and until recently, Real Estate which have been on fire.

I have been choosing funds for the Wylie portfolio among Growth and Value businesses across companies of all sizes. But even in these ‘categories’, some go up while others go down. So if you have money to invest, it is not a bad idea to see which category has lagged behind. If you invest in sectors, the same concept applies.

One easy way to find out how sectors or categories are performing is to use Morningstar's free list of performance by category. This list mixes in what I am calling categories and sectors. There are many ways to build diverse portfolios, but you gotta pick one if you are going to get started and I picked categories (Large Growth, etc.).

Tip two: Invest in categories that are lagging behind.

Another thing to consider is that stock prices are generally based on some combination of how a company is doing and how investors think the company will do in the future. But investors use all sorts of different formulas to determine how profitable a company really is and to guess what impacts new products or ideas will really have. The way accounts 'expense' stock options as part of employee compensation, how the iPhone will boost or detract from Apple’s free cash flow... who knows? Part of why I am looking at mutual funds is I do not have enough time to analyze or stay on top of enough individual companies to build a good diverse portfolio.

Morningstar, pays lots of people to try and do this though, and they have a specific approach to calculating what they call Fair Value Estimates. Then they take these values and track indexes to determine if the markets those indexes track are fairly valued. Finally, they share this information for free. In part I, we looked back and saw that not buying because stocks are overvalued can lead to missed gains, but when the bubble popped, extremely high valuations were a sign that some heeded ahead of time and they were happy they did. I wish Morningstar's tool actually tracked valuations by category and included international companies as well but you get what you pay for I guess.

Tip three: Invest when markets are undervalued.

So we have three gauges to help identify good times to invest.

The general concept is, when the US market is broadly undervalued, identify which market categories specifically have underperformed and on a specific day when the market is down a good bit, buy.

No one tip or even all three will enable you to identify the perfect time to invest. Part III of this series will look at how to hypothetically jump into a Wylie portfolio like the one I am putting together on this site, using these three general ideas in a systemic way.

0 comments Posted by Healtyboy at 5:59 PM

In Honor of Bilbo

Here is a picture of Bilbo in his yard after a snowfall (Ice actually. Notice the lack of paw prints!):

0 comments Posted by Healtyboy at 5:59 PM

Labels: Random

Thanks for Donating!

A few of you have donated to the Walk for Hunger in support of my team and I thank you! You have also let me know that it does not appear that your donations are being associated with my team. I have several emails in to Project Bread to try and fix the problem.

If you have made or make a donation, you will get an email- please reply to the

email and let them know you made it in support of this team if it does not show up on the Wyliemoney Walk for Hunger page or if it does not state in the email that it was given in support of Wyliemoney.

I will call them tomorrow and try and sort out the issue. Rest assured that regardless of whether the donation is associated with my walk, Project Bread will put it to good use.

Thanks!

0 comments Posted by Healtyboy at 5:57 PM

Labels: Giving

Thursday, March 26, 2009

When to buy Mutual Funds Part I

It is often said, "You can't time the market."

What does this mean?

In general it means you never know what will happen tomorrow.

If you thought the market was ready to slump after its nice run up before 1999 and not invested in the beginning of 1999, in some cases you would have missed the largest one year returns we may ever see in our lifetime. Data courtesy Yahoo Finance for Janus Global Technology fund:

By all accounts, many of the stocks in this fund were trading at prices way above historical averages given what the underlying companies were earning, even before they proceeded to double in value in less than a year.

Stock prices and therefore fund prices are not driven by fundamentals, but by what people are willing to pay. Many people determine what they are willing to pay based on fundamentals, but many people do not. And in either case you still have to guess how you think the economy will do in the future. Had you invested at the beginning of 2000 thinking that this is a new economy and historical valuations do not apply because technology is going to enable corporate growth to expand at levels never before imagined, you would have been very sad by the end of 2002. Again consider Janus Global Technology:

Since 2002, markets around the world have gone up, almost across the board. Small and large company stocks have increased. Growth and value oriented companies have done well. Historically when oil prices have soared, economies have struggled as the added cost of manufacturing and transportation have been factored into the price of goods, lowering sales or reducing profits. Recently this has not been the case as companies across all sectors have grown and earned significant profits. Some claim tax cuts in the US are the cause, but European markets despite much higher taxes have trounced American markets so I am hesitant to attribute any single factor to these trends. Despite a long run of gains, stock price valuations are nowhere near as high as they were in 2000. So what does all this mean?

Beats me, I'm a philosophy major.

Some claim that current valuations are too high as they are calculated anticipating that above average growth will continue for a while which is possible, but unlikely given historical trends.

Some think the economy is ready to pick up steam. Would you trust this guy?

Others say things are not good, not bad.

One of the reasons the hypothetical portfolio I am creating here only holds funds that allow $100 or smaller subsequent investments is to not have to figure out how to time the market. My thinking is that if I buy a fund and contribute $100 every month, every 2 months or once a quarter, the exact timing of each purchase will not have a significant impact over the long term as the cost of the overall holdings will be the average of each purchase through up and down markets. If the sector the fund invests in grows and the fund managers make good picks, I should come out ahead.

I agree that you can not time the market, but you do have to determine a time to make the initial investment. And no advice works in every situation. If you had cash to invest in January 2000, the notion that you can't time the market so just buy when you have the cash, would not have been good advice. So even though I agree with the claim that you can't time the market, there are, good and bad times to invest and more importantly good and bad strategies for investing. And even if you buy into the Wylie idea of regular contributions, you still have to make the initial purchase which for the funds I am looking at are often a minimum of $2500.

So even though you cannot predict how markets will perform there are a couple of tools out there that you can use to see if it is a good time to buy or not and hopefully avoid buying at a market peak.

In part II I will talk about these tools and lay out a strategy for hypothetically investing in the Wylie hypothetical portfolio. Then I will pick the last few funds necessary to round out the portfolio and begin tracking the performance of the portfolio.

0 comments Posted by Healtyboy at 7:54 PM

Labels: Economy, Investing, Mutual Fund, Timing

Giving: Walk for hunger

Wylie walks for Hunger! Click here to donate.

On May 6th, 2007 I will be participating in the Walk for Hunger in Boston. My wife has been participating for a while and got me hooked when we met and we have done it together each Spring. It has become a seasonal tradition- when we get up early Sunday morning and head down to the Boston Common, we know that spring has finally arrived.

I have not done much to try and raise money in years past and have been content to just make a donation myself, but a friend who walked last year created a page on the Walk for Hunger site and asked for donations. The great thing about donating this way was I could do it online with a credit card and I got an email right away with all the information I needed to write it off my 2006 taxes! The great thing about raising money this way is I do not have to collect checks or ask for folks to pledge and then track down money later.

So this year I signed myself up with a Walk for Hunger web site and am asking Wyliemoney readers looking for a charity to make donation to Project Bread is support of team Wyliemoney. You can give as little or as much as you like and you can donate anonymously if you prefer.

If you want to give, just click here, and find a credit card that will give you cash back, airline miles, or donate to a different charity (yes there are cards that do that too!).

That way you do not have to worry about me pocketing your donations and turning my hypothetical portfolio into a dream come true!

If you do not have money to donate now, or even if you do, please forward this to friends or family who might be willing to donate!

When I do the walk, I will take some pictures and report back about the day.

0 comments Posted by Healtyboy at 7:53 PM

Labels: Giving

U2's The Edge to become a Doctor

That's right- Dr. Edge. money

Gloria and Emilio Estefan and Andrew Hill are also becoming doctors but none of their new titles will be as cool as "Dr. Edge." money

On May 12th these folks will be receiving honorary Doctor of Music Degrees from Berklee College of Music. money

In honor of how cool this is, I am adding the Edge's charity- Music Rising to the Wylie list of charities worth considering when you're ready to give. money

0 comments Posted by Healtyboy at 7:53 PM

Labels: Giving

Free art! Free wine!

The psyche needs beauty. money

Riker sums it up in Human Excellence when he states "From its unequaled exposition in Plato's Symposium, through its worship by the Romantics, to its grounding of Whitehead's vast metaphysical system, the desire for beauty has been recognized as a basic human need.*" money

So how is a wylie spirit to meet this basic human need without spending money?

Check out local open studios. Some of the artists you will encounter may be at the ummm... "early" stages of their careers, but some artists are creating amazingly rich art and are showing it for free. money

One example of the latter type of artist is Dave Anastasi who runs the site east3rd.com and is participating in the Somerville Open Studios May 5-6. 2007. money Dave explains: "This show will be a celebration of alcohol, with its vibrant colors and seductive curves captured in a series of abstract photographs. Wine and hor d'oeuvres will be served.' money

Dave explains: "This show will be a celebration of alcohol, with its vibrant colors and seductive curves captured in a series of abstract photographs. Wine and hor d'oeuvres will be served.' money

Not only does the frugal connoisseur of fine art have an opportunity to check out great up and coming artists, she finds free drink and food in the process. I imagine Dave is not the only artist of the 300+ participating who is serving snacks. money

The risk here is that you will find an item that you want to buy, thus rendering ineffective your frugal plans. If this is the case, and your judgment has not faltered after a day of cheap Bacchic revelry and the piece you intend to purchase is awesome, do not feel guilty. money

Purchasing seductive pictures of alcohol along with activities like donating time and money to charity are among the reasons we save and attempt to build wealth in the first place, right? money

Events are scheduled all year long- Boston Area open studios:

- Allston/Brighton Open Studios

- Boston: Fort Points Arts Community

- Boston (South): Distillery Open Studios

- Charlestown: Artists Group of Charlestown

- Dorchester Open Studios

- Fenway: Friends of the Fenway Open Studios

- Framingham: Fountain Street Studios

- Jamacia Plain Open Studios

- Roslindale Open Studios

- Roxbury Open Studios

- Somerville Open Studios

- South End: United South End Artists Open Studios

*John Riker, Human Excellence and an Ecological Conception of the Psyche (New York: State University of New York Press, 1991), 101. money

0 comments Posted by Healtyboy at 7:53 PM

Why we save...

Back when I first started putting together list of tips for living below your means, a wylie reader commented to me that one way to save money was to not give to your local public radio station. money

While I must give props for factuality- you will have more money in savings if you do not give any of it away- I must take the props away because this suggestion is evil. money

And by evil I mean 'not good.' money

I do not mean to suggest that it is evil to not give to public radio. This tip was inspired by marketing almost as annoying as a head on commercial. And bad marketing is worthy of lengthy criticism. Whether or not you give to public radio specifically is up to you. Whether or not you give at all is a different issue altogether. money

MFJ over at myfinancialjourney wrote a very nice post about the fine line of frugality- specifically in regards to giving. And whether or not you have- or think you have- enough money to give some away, you also have time, sweat, and support that you can give. money

So I would be ok with suggesting that one way to save is to find a charity you want to support and volunteer if you cannot afford to give cash. But if you can afford to give money, where should you give? money

Beats me- that is up to you. money

But I am going to list some organizations my wife and I have given to and invite you to share ideas too. If you have suggestions please add a comment on this post or send me an email at wyliemoney at gmail dot com and I will add them to this list. money

Health/Quality of Life

- American Cancer Society

- American Heart Association

- Children's Hospital Boston (Thanks Kate)

- Hospice Foundation of Cape Cod

- Jimmy Fund (Thanks Anne)

- Leukemia & Lymphoma Society (Thanks Kate)

- Seven Hills Foundation

- St Jude Children's Hospital (Thanks Anne)

- Boston Jewish Film Festival (specifically in support of Lisa Gossel's film Imagining Peace

- Independent Film Festival of Boston (Thanks Sean)

- Institute of Contemporary Art, Boston (Thanks Greg)

- Isabella Stewart Gardner Museum (Thanks Greg)

- Museum of Fine Arts, Boston (Thanks Greg)

- Habitat for Humanity (more about this soon!)

- Heifer International (Thanks Sean)

- Project Bread (Wylie walks for hunger!)

- Berklee College of Music

- Colorado College

- Hispanic Scholarship Fund (Thanks Gina)

- Ruby Central (Thanks Sean)

Services

- Massachusetts Volunteer Firefighters (Thanks Kate)

- Trustees of Reservations (Thanks Kate)

- Music Rising (Thanks Dr. The Edge)

0 comments Posted by Healtyboy at 7:48 PM

Tuesday, March 24, 2009

Tips for saving for pet owners...

...or would be pet owners. money

Jonesy offers the tip:

"Rescue your pets, don't buy purebreds. They will be better pets anyway." money

Jonesy's supporting argument:

And Holly explores pet ownership in great detail. money

My family's pet, Bilbo:

I have a pet squirrel that lives in my basement. And last summer I had a family of pet skunks living under my front porch. By pets, in this case, I mean "beasts that torment me."

Squirrels moments before they pried open the suet feeder and robbed a couple of woodpeckers of many scrumptious meals: money

I actually did get rid of the animals without paying hundreds for pest removal. With the squirrel, I left the bulkhead open until it got hungry and found its way out (to the bird feeders) and then I sealed up the hole that the squirrel had made (to help me ventilate the basement) with some old bricks I had in the back yard. money

With the skunk family (we saw at least three), after several nights of odoriferous entertainment, I simply started filling in the hole they made (to help ventilate the space under my porch). They would dig out or dig back in, depending on where they were when I filled in the hole and share their skunky smell to let me know how much fun they were having re-digging the hole. I did not try and permanently seal it up, because I did not know if they were under there when I was closing the hole and I did not want to trap them under my house. After a few days no new hole appeared so I determined the skunk was skulking off somewhere else and dug deep around the porch- I could then see up into the "den" and saw it was empty. I buried bricks in the ground so that the hole could not be easily re-opened. money

I could have paid hundreds to have the skunks trapped and removed, but I paid nothing and have not been bothered again (yet!). money

Ok, ok- pest removal has nothing to do with pet ownership, but my beta fish swam off to the great sea out west a while ago and the only "pets" I have now are the coyotes, foxes and hawks that live nearby (maybe there are other reasons the squirrels and skunks are not bothering me anymore). money

Coyote sitting in my backyard in broad daylight:

0 comments Posted by Healtyboy at 5:41 AM

Labels: Saving

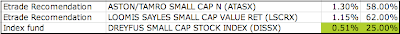

Non-Retirement: Small Cap Blend Mutual Fund

Wylie Pick: Dreyfus Small Cap Stock Index DISSX

Selecting from mutual funds available through Etrade with no load or transaction fee and an initial $2500 investment or lower minimum and subsequent $100 or lower minimums, when looking for a Small Cap Blend fund, I use the Mutual fund screener to screen out options with 3, 4, or 5 stars and find a number of choices. money

There are a few index funds and a number of actively managed funds two of which are recommend by Etrade. Like the Mid Cap Blend pick, I am going to pick an index fund in the Small Cap category for a couple of reasons. The Small Cap Growth and Value picks are both actively managed so if Wylie were to actually buy these funds, an index fund would be a good diversification next to these. money

More importantly, the managed funds are more expensive, generate more tax exposure and have not consistently out-performed to overcome these negatives. money

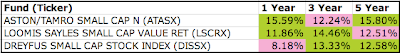

Allow me to illustrate:

The expenses and the turnover of the Index fund are less than half those of the two actively managed funds. money

When you use Yahoo charts to look at the year to date performance of these three funds, the index fund (blue) is off to a rough start. It is upu for the year, but trailing the competition.

Jump back to mid 2002 and buy in and the index fund actually comes out ahead. money

Looking at the performance record, each fund has underperformed the other two during one of the periods over 1, 3 and 5 years. money Given the solid long term record, lower expenses and turnover, Dreyfus Small Cap Stock Index is the Wylie pick. money

Given the solid long term record, lower expenses and turnover, Dreyfus Small Cap Stock Index is the Wylie pick. money

0 comments Posted by Healtyboy at 5:40 AM

Labels: Mutual Fund, Non-Retirement

Non-Retirement: Bond Inter. Term Mutual Fund

Wylie Pick: Managers Bond MGFIX

Selecting from mutual funds available through Etrade with no load or transaction fee and an initial $2500 investment or lower minimum and subsequent $100 or lower minimums, when looking for an Intermediate Term Bond fund, I use the Mutual fund screener to screen out options with 4, or 5 stars and find 6 choices. money

Click the image for a larger view comparing the funds as of Etrade's data on 3/25/07:

Westcore Plus and Managers are the two 5 star funds and they have both been 5 star funds over 1 year, 3 year, 5 year and 10 year periods. money

Westcore Plus Bond has trailed Managers Bond slightly and has slightly more risky holdings (A instead of AA) so despite higher expenses and higher turnover, Managers is the pick for this hypothetical portfolio as it has out performed all along the way and has more management expertise. money

0 comments Posted by Healtyboy at 5:39 AM

Labels: Bond, Mutual Fund, Non-Retirement

What investment records should you keep?

Keep them all. money

Lots of financial sites and blogs post articles offering advice about what records to keep in general: bankrate, soundmoneytips, realsimple, even the IRS has made an attempt.

As is often the case, Morningstar has one of the best explanations for why this matters when it comes to investment records. money

I keep every monthly statement from my brokerage and have a file over 2 1/2 inches deep to show for it. I wish this was an indicator of massive wealth, but really it is just a symptom of reinvested dividends. money

If you put $500 in a growth and income fund and reinvest the dividends and capital gains, each payment- in cents, dollars, whatever, is a transaction on the statement. And at the end of the year, you pay income taxes on those payments, even though they are (re)invested, and not cash in your pocketses. So if you do not have a ton of money (yet!), but still want to diversify broadly and put a small amount of money in a number of funds instead of just piling it all into one, your statements get long. money

Some of the new retirement funds like Vanguard Target Retirement 2050 are actually a collection of funds, so you can put all or some of your money in one of these, even if you do not plan to save it until retirement, and diversify that way, but I digress money

Some brokerages are no longer sending paper statements automatically and actually charging investors for this 'privilege.' Here is Ameritrade, disclosing its fees: So if you only get electronic statements, or opt to get electronic only, you have to keep those too. And back them up! money

So if you only get electronic statements, or opt to get electronic only, you have to keep those too. And back them up! money

I finally got my 3rd and 4th brokerage account tax statements. One of these adjustments changed how $22.46 was allocated for tax purposes. I waited a month and a half to file my taxes because of how $22... good grief. money

So anyway, I sold a fund last year and I knew how much I originally invested, and Etrade does a good job of keeping track of funds that have automatically reinvested since they bought my account from my previous brokerage. My old records, however, did not convert to my Etrade account so I had to go back through my paper records starting in 2000 when I bought the fund to calculate my actual basis. This took me about 3 minutes to do because I had all my records in order and this changed my basis by a couple of hundred dollars which lowered my tax bill enough to buy a decent bottle of wine! Or, if I shop at Trader Joe's, 3 or 4 decent bottles of wine! money

So the lesson here is that you should keep your statements, paper or electronic, because your brokerage may be bought by a competing brokerage, or it may raise its fees and you may transfer your account to a better brokerage and all your details may not transfer over. And unless you want to pay the tax man (or woman) for the same profits twice, you'll want to be able to add up your actual basis, not just the amount you originally invested and having your statements handy and organized makes this pretty easy. money

0 comments Posted by Healtyboy at 5:39 AM

Labels: Brokerage, Capital Gains, Investing, Mutual Fund, Non-Retirement, Taxes

Non-Retirement: Foreign Emerging Markets Mutual Fund

Wylie Pick: SSGA Emerging Markets SSEMX

Selecting from mutual funds available through Etrade with no load or transaction fee and an initial $2500 investment or lower minimum and subsequent $100 or lower minimums, when looking for a Diversified Emerging Markets fund, I use the Mutual fund screener to screen out options with 3, 4, or 5 stars and include choices with higher expenses since generally, international funds have higher expenses. money

I find three options: Excelsior Emerging Markets UMEMX, Managers Emerging Mkts Equity MEMEX, and SSGA Emerging Markets SSEMX. money

Each has outperformed the other two in one of the standard periods used to calculate returns (1 year, 3 year, or 5 year). SSEMX is the only one with a 10 year record (10% average annual return). money

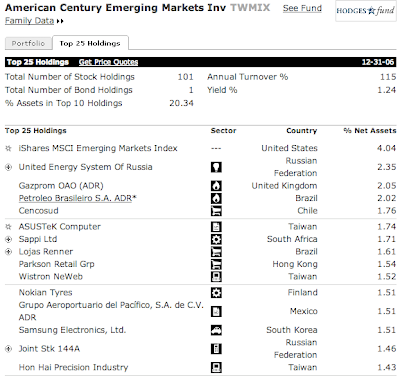

I also looked at funds with very high turnover and find Amer Century Emerging Markets Inv TWMIX. It has an astonishing 115% annual turnover. Its one year return is 30%. Compare that to SSEMX at 16.83%. money

TWMIX's top holding is an Emerging Markets ETF. money

Its third top holding is a company that is the second biggest holding of that ETF. money

Gazprom has been creating billionaires in Russia for several years as it is basically the largest 'privatized' company in Russia and is the biggest extractor of natural gas and the third biggest oil company (according to somebody who wrote it in wikipedia... hehe) . Note that Gazprom is listed under the country 'United Kingdom' on these charts. Welcome to the wild world of trying to invest in international businesses in emerging markets. I'm guessing this discrepancy is because shares of Gazprom are traded on the London stock exchange, but I could be wrong. money

Regardless, TWMIX has an expense ratio of 1.85% compared to SSEMX at 1.25%. If I wanted to buy an ETF, I would pay $10 for the transaction, not pay some fund manager 1.85% annually to do it for me. And though TWMIX has been on fire recently, it is making up for lost time as it trails SSEMX over 5 years. If you want to chase hot returns, feel free to look into TWMIX. But TWMIX's high expenses and turnover steer me away. money

So the other funds I originally pulled up also have expenses 1.75% or higher. MEMEX has a 3 star rating while SSEMX has 4. money

And UMEMX has trailed the average Emerging Markets fund recently.

SSEMX with low expenses and a good long term track record looks like the best offering for this portfolio. money

0 comments Posted by Healtyboy at 5:37 AM

Labels: International, Mutual Fund, Non-Retirement

Sunday, March 22, 2009

Non-Retirement: Mid Cap Value Mutual Fund

Wylie Pick: Marshall Mid Cap Value Inv MRVEX

Selecting from mutual funds available through Etrade with no load or transaction fee and an initial $2500 investment or lower minimum and subsequent $100 or lower minimums, when looking for a Mid Cap Value fund, I use the Mutual fund screener to screen out options with 4 or 5 stars and find 4 options. money

I'm bummed about this pick. When I am done building the entire hypothetical portfolio I'll note which ones I own and which different fund I own instead, if I don't own the one recommended for this portfolio. In each case I am picking a fund I own or one I would buy instead if I was looking for a fund in that category today. With this category I will be noting that I own Janus Mid Cap Value Inv (JMCVX). I wish it was still open to new investors so I could recommend it. It has cheaper expenses and good long term performance. money

Actually, I do not think this fund is closed. Morningstar makes no mention of it being closed. More to the point, Janus does not indicate they have closed this fund on their site. The Janus Small Cap Value fund is closed. And the Mid cap fund is huge as far as how much money it has under management so I would not personally be disappointed if it did close. But folks... closed it ain't. money

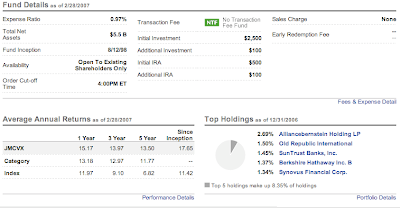

Here is Etrade's info for fund JMCVX:

If anyone wants to call Etrade's customer service, and try to get to the bottom of this, feel free, but I would not expect much success. In fact, if this kind of discrepancy drives you nuts, you may want to pick a different brokerage as I find this kind of inconsistency on a pretty consistent basis with Etrade (of course I have not used a brokerage that I would recommend instead of Etrade as long as you meet the minimum balance requirements). I do find though, that the inconsistencies are consistently inconsistent. By that I mean, they may be wrong about the fund being closed, but I bet they are wrong about it throughout their site including the tool that would actually allow or restrict your purchase. money

Anyway, one of the 4 funds available for purchase, is not your general Mid Cap Value fund. Fortunately its title indicates this: Icon Materials (ICBMX). Looking at the Industry allocation, you can see that this fund is focused on the Materials sector. If I add sector funds to this hypothetical portfolio, I will check this out again. money

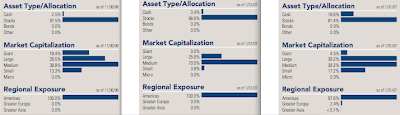

The remaining three funds have similar returns. But only one of the three (MRVEX- The one in the middle!) is solidly invested in Mid Cap companies (Medium Market Capitalization) while the other two (SMCDX and HRSVX) have more invested in non-medium size companies than they do in medium sized ones. money

Fortunately it also has the lowest expense ratio so that makes it an easy choice since we are building a portfolio of funds that are more or less true to their categories and have lower than average expenses: Marshall Mid Cap Value Inv (MRVEX). money

0 comments Posted by Healtyboy at 1:59 AM

Labels: Mutual Fund, Non-Retirement

Non-Retirement: Foreign Large Cap Growth Mutual Fund

Wylie Pick: Janus Overseas JAOSX

Selecting from mutual funds available through Etrade with no load or transaction fee and an initial $2500 investment or lower minimum and subsequent $100 or lower minimums, when looking for a Foreign, Large Cap Growth fund, I include higher than normal expenses and turnover in the Mutual fund screener to find seven options. money

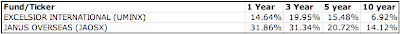

One of the seven funds is picked by Etrade as an "All Star" fund. Basically Etrade identifies funds they like in each category and flags then as All Stars. Several of my picks so far have also been picked by Etrade as All Stars but in this case, I think there is a better option. They recommend Excelsior International (UMINX). I like Janus Overseas (JAOSX). money

Etrade's pick has a 'moderate' risk assessment while the Janus fund is assessed as 'high' risk.

Just to be clear- investing in this category can be a wild ride. But despite the assessment that UMINX has less risk than JAOSX, the worst one year performances show that UMINX has had a worse one year downward run (-27.43) than JAOSX (-23.89). money

And Janus has been very well rewarded for its approach. I by very well I mean spectacularly rewarded. money Since the Janus fund has crushed the Excelsior fund in every period- most importantly the 10 year period, it would have to have pretty high expenses or high turnover or a new manager or something significant to make me think twice about not choosing a consistent winner like this. I do not anticipate that future returns will be this good but a fund with a long track record of tremendous performance has a lot going for it. money

Since the Janus fund has crushed the Excelsior fund in every period- most importantly the 10 year period, it would have to have pretty high expenses or high turnover or a new manager or something significant to make me think twice about not choosing a consistent winner like this. I do not anticipate that future returns will be this good but a fund with a long track record of tremendous performance has a lot going for it. money

Turns out JAOSX has 5 stars from Morningstar, UMINX gets 4. JAOSX has lower expenses: 0.9% compared to 1.5%! JAOSX does have higher turnover- it is 62% compared to UMINX's 26%. The other 5 Foreign Large Cap Growth funds that came up in my search have turnover ranging from 72% to 138%, all higher than JAOSX so I do not mind a little more churn if the performance is this much better. money

Janus Overseas' manager Brent A. Lynn took control of the fund on 01-01-2001. Check out this chart (From Yahoo) and look at this manager's first two years! That must have been rough. money

The manager of the Excelsior fund has not been at the helm for quite as long but he also started in 2001. money

So crushing returns, the lowest expenses, etc. The Wylie pick is Janus Overseas JAOSX.

0 comments Posted by Healtyboy at 1:58 AM

Labels: International, Mutual Fund, Non-Retirement

Government passes law to steal from citizens

So like I predicted, I got four tax statements from my brokerage account. money

What a pain. money

I received two statements because my old brokerage was swallowed up by my new brokerage and I got two more statements supposedly because recent changes in tax law have made it so difficult for companies to figure out how to report their profits that it takes over two months just to do the math. money

That's right- I got home from work- after spending my day doing my part to keep the GDP strong while markets around the globe writhe in agony- to find two updated tax statements.

Thankfully, Etrade had alerts on its site indicating that this would happen so I avoided filing taxes only to have to refile. money

And yes- the title of this post is a bit of a stretch, but here is my thinking: money

The government has passed regulations so complicated that it now takes much longer to run the numbers so many investors find it more difficult to file taxes until much later meaning...

The government gets to keep my tax withholdings for longer. Since I am not being paid interest on this, this money can be put to use, grown, used as green wallpaper, whatever.

So rather than raise taxes- politicians should just continue to make regulations more and more difficult so that the government can hold tax payments for longer periods, collecting the interest on my money. money

Wait a minute you say- Wylie does not usually rant and rave and spin conspiracy theories... Well I just picked a bond fund which is pretty boring, so I'm trying to be more... lively. money

Plus, even the folks in Hawaii are agitated about this one. money

0 comments Posted by Healtyboy at 1:57 AM

Labels: Taxes

Friday, March 20, 2009

Non-Retirement: Bond Short-Term

Wylie Pick: American Performance Short Term Income APSTX

Selecting from mutual funds available through Etrade with no load or transaction fee and an initial $2500 investment or lower minimum and subsequent $100 or lower minimums, when looking for a Short-Term Bond fund, I have five options. money

Two options have a 5 star rating from Morningstar. They are both American Performance funds but one is called "American Performance Interm Bond Fund." This caught my eye because Intermediate Bonds are held for a longer term and ahve their own category and after jumping over to morningstar, I find that in December of last year, this fund switched from the Intermediate category to Short-Term. money

Since I am looking for a Short-Term fund, I rule this one out as an impostor but it illustrates an issue- funds with categories in their titles can be deceptive when a category changes but the title does not. money

So that leaves one 5 star fund and since it has low expenses, American Performance Short Term Income APSTX is our pick. money

0 comments Posted by Healtyboy at 9:32 PM

Labels: Bond, Mutual Fund, Non-Retirement

Non-Retirement: Foreign Large Cap Value Mutual Fund

My Pick: Harbor International HIINX

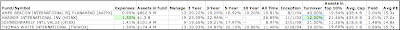

Selecting from mutual funds available through Etrade with no load or transaction fee and an initial $2500 investment or lower minimum and subsequent $100 or lower minimums, when looking for a Foreign, Large Cap Value fund, I have four options. Click the table below for a larger view: American Beacon International Planahead AAIPX is appealing because of it's low expenses. Indeed, I picked American Beacon Planahead as a good Domestic Large Cap Value fund. Harbor International has a much lower turnover which should help keep taxes down and has performed better than American Beacon. Thomas White has also performed better, but its expenses are higher and turnover is the same as American Beacon. money

American Beacon International Planahead AAIPX is appealing because of it's low expenses. Indeed, I picked American Beacon Planahead as a good Domestic Large Cap Value fund. Harbor International has a much lower turnover which should help keep taxes down and has performed better than American Beacon. Thomas White has also performed better, but its expenses are higher and turnover is the same as American Beacon. money

Upon further research, I discover that .25% of Harbor's expenses are what is known as 12b-1 fees. I think of these fees as marketing fees and they have gotten a lot of bad press in the last few years. After all, why should fund holders shoulder advertising costs for fund companies?

In particular Dustin Woodard wrote at length about 12b-1 fees and how he feels the way Etrade handles them is deceptive and bad. While I understand Dustin's point, I disagree with his conclusion. Etrade rebates fund owners 50% of these fees. So for anyone buying Harbor International via Etrade, the expense ratio you will pay is not 1.30%, it is closer to 1.18%. Dustin's point is that this encourages folks to buy funds with bad fees, but it does not make sense to me to pick a fund with 1.30% that does not charge 12b-1 funds versus one with 1.30% that does since I will pay less fees by choosing the one that includes the 12b-1 fee all other things being equal. Perhaps Dustin's concern is that most fund consumers won't understand how to research the other things- Loads, transaction fees, etc. In this case, with the rebate, the fees for Harbor International are much closer to those of American Beacon and the turnover is half as much. money

Actually, Morningstar reveals that Harbor's fees and turnover have both gone down even more since the beginning of the year. So due to slightly better performance, lower turnover and similar fees, I choose Harbor for this category. money

0 comments Posted by Healtyboy at 9:31 PM

Labels: International, Mutual Fund, Non-Retirement

Ouch!

In honor of today's massive sell off, I'm changing the picture on my blog. The old picture is down on the right. money

Ironically, the old picture was a bunker on top of Golden Gate Park North of San Fransisco. It's original purpose, I am told, was to serve as a guard post keeping an eye out for dangers from Asia during World War II. money

The pundits say that part of today's bloodbath in US markets was due to a huge sell off in China's stock markets. So perhaps no-one was in the bunker... money

Actually, if you look closer you can see clearly that there are people in the bunker:

I guess they do not know where the "Off" button for the Market is... money

Anyway- my new picture is of a sunset behind the remnants of a forest fire in the Boundary waters Canoe Area. Every now and then, devastation rolls through. Hopefully new growth will come along more healthy and robust (and Green!) than before. money

0 comments Posted by Healtyboy at 9:29 PM

Thursday, March 19, 2009

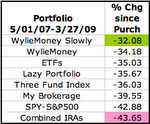

The Wylie portfolio vs Lazy and Kevin!

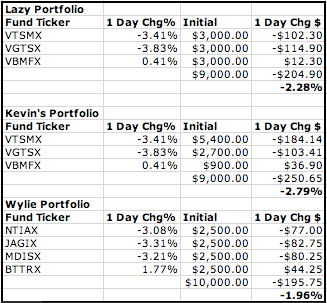

After yesterday's sell off, I went back and looked at the one day performance of my recommendations compared to the lazy portfolio. I anticipated that my managed funds (Well the NTIAX is an index fund but the others are managed) would have under performed Vanguard's low cost index funds. Now let me be clear- this is not an apples to apples comparison. My allocation is not invested in the same categories as the lazy portfolio. But if somone came to me and said- "I want to invest $10,000 in some mutual funds.., any funds worth researching?" These are the one's I would think about... money

After realizing my funds did not lose as much, I ran the numbers on Kevin's actual allocation too. money I am not sure what this indicates exactly- the Vanguard funds invest very broadly so maybe this simply means that yesterday's sell off was very broad and that my funds were a little better positioned for this round. All my stock funds did better than the Vanguard stock funds but the real difference was my bond fund which is a not at all like the broad Vanguard bond fund of the lazy portfolio. money

I am not sure what this indicates exactly- the Vanguard funds invest very broadly so maybe this simply means that yesterday's sell off was very broad and that my funds were a little better positioned for this round. All my stock funds did better than the Vanguard stock funds but the real difference was my bond fund which is a not at all like the broad Vanguard bond fund of the lazy portfolio. money

Anyway- not much use in looking at daily performance of funds for the kind of investing I am exploring- except to be sure you can stomach some sadness. money

0 comments Posted by Healtyboy at 6:32 AM

Labels: Economy, Investing, Mutual Fund, Timing

Misleading article about building a 'lazy' portfolio.

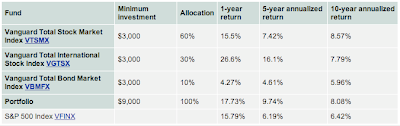

Paul Farrell wrote an article the tone of which is "even a second grader can invest in a simple portfolio and beat the market." As I started to read through this, I saw several things that bugged me so I decided to explore in greater detail. money

The first thing that stands out is that to set up this portfolio you need a parent who has enough invested at Vanguard to waive the minimum requirements for each fund. So not any second grader could do this but second graders with parents who have some unspecified amount of wealth invested at Vanguard can do this. money

Let's assume that not everybody has parents with huge investments at Vanguard but is looking for a way to begin investing. Does this approach still make sense? From what I can tell after poking around on Vanguard's site, this simple portfolio would be assessed a $30 annual fee until little Kevin's account was worth at least a quarter of a million dollars. In addition to that, each individual fund has another annual $10 fee until each holding is worth $10000. money

So this lazy portfolio would cost $60 per year in fees. Now $60 is only a very small percentage of $9000 and these funds have very low expenses assessed within the funds themselves, but these fees make me mad anyway and should at least be mentioned. money

Then, what really caught my eye was this chart which is terribly deceptive: The $3000 minimums listed do not represent the allocations used to calculate the actual returns. There is a column called "Allocation" that clarifies the actual allocation used to calculate the returns, but these allocations are not allowed in Vanguard funds to for the typical investor with this much to invest. So for those of us whose parents don't have their nest eggs socked away at Vanguard, this portfolio, with equal $3000 amounts invested in each fund, would have under performed the S&P 500 over a 1 year period, not out-performed it as listed. And the performance above the S&P over the 5 and 10 year periods would not have been as great and none of these returns factor in the $60 in annual fees. Again these fees are not huge but over 10 years they total $600. 1, 5, and 10 year annualized returns with equal weight in the 3 funds would have been: 15.45% 9.38% 7.44% -not shabby, but not what is listed.

The $3000 minimums listed do not represent the allocations used to calculate the actual returns. There is a column called "Allocation" that clarifies the actual allocation used to calculate the returns, but these allocations are not allowed in Vanguard funds to for the typical investor with this much to invest. So for those of us whose parents don't have their nest eggs socked away at Vanguard, this portfolio, with equal $3000 amounts invested in each fund, would have under performed the S&P 500 over a 1 year period, not out-performed it as listed. And the performance above the S&P over the 5 and 10 year periods would not have been as great and none of these returns factor in the $60 in annual fees. Again these fees are not huge but over 10 years they total $600. 1, 5, and 10 year annualized returns with equal weight in the 3 funds would have been: 15.45% 9.38% 7.44% -not shabby, but not what is listed.

I do not want to be too critical of Mr. Farrell because I appreciate his approach in general: to advocate simple, diversified low cost portfolios that take very little management. But part of why I started my project was because none of the pundits writing about various methods for building portfolios actually ground their recommendations in the real world with portfolios you can really build with little money to start and with clarity about the fees. money

What I am doing on my blog is using Etrade to propose a portfolio that you can actually buy, with $2500 minimums and no fee $100 monthly additions. Etrade has a $10,000 account minimum or an absurd $40 per quarter fee. So my hypothetical picks would not be good for someone with only $9,000 either. But if you have the $10,000 total, there is no individual fund fee or account fee in addition to this if you are using Etrade. The first four funds I recommend with $2500 minimums in each would total $10,000 but you should be sure and add a little more than this to avoid Etrade's absurd $160 annual fee in case these funds lose value in the short term. money

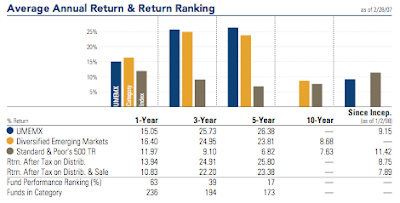

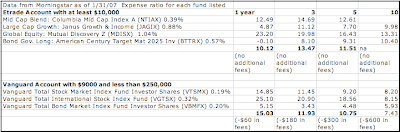

I've written before about my issues with coming up with accurate statistics- indeed the chart above does not clarify if dividends are reinvested or not to achieve these averages. But I am going to show you the results of my picks according to the same source Mr. Farrell uses so you can compare: money The lazy portfolio beat my hypothetical portfolio over the past year, but my portfolio come out ahead over 3 and 5 year periods. The Mid Cap Growth fund I recommended has not been around for 10 years so I cannot compare a total 10 year performance, but the other three funds I recommend have all outperformed every one of the Vanguard funds over 10 years. money

The lazy portfolio beat my hypothetical portfolio over the past year, but my portfolio come out ahead over 3 and 5 year periods. The Mid Cap Growth fund I recommended has not been around for 10 years so I cannot compare a total 10 year performance, but the other three funds I recommend have all outperformed every one of the Vanguard funds over 10 years. money

My point in all of this is that it would be nice if people talking about how simple it is to invest would be clear about fees and minimums and use actual, possible scenarios that anyone can follow (at their own risk of course!). money

0 comments Posted by Healtyboy at 6:32 AM

Labels: Brokerage, Investing, Mutual Fund, Non-Retirement

Tips for saving while keeping fit

Jonesy suggests: "Cancel the gym membership you never use and go for a run. Buy a set of used dumbells and exercise while you watch 24 and LOST." money

and Sean adds: "You don't need the fancy equipment and gym clothing to sit in a chair and pump out a dozen bicep curls. A bit of a tangent, but when I still had my gym membership, I loved to go because they had tvs built into the cardio equipment. It was great for the winter, and it was a good motivator, too. 'If I stop now, I won't see the end of Seinfeld! Keep going!'" money

"The other side of that is that I could never understand the people who would stand on a treadmill and flip channels for, literally, 5-10 minutes to find something good before starting up. You could have at least been walking! What a waste." money

- So to clarify- If you do not use your gym membership enough to justify the cost- cancel it and exercise at home. If going to the gym is important to you then do not cancel it to save money- instead, be sure you are not wasting time- or hogging the treadmill- by surfing and standing!

- Be sure you are taking advantage of all the benefits of your health insurance.

0 comments Posted by Healtyboy at 6:31 AM

Labels: Saving

Credit card offers and stopping junk mail

Last week a friend asked me if I knew of any credit cards offering 0% balance transfers to finance a new refrigerator and dishwasher. Instead of going through my junk mail, I went to the interweb. After a great deal of crazy and masterful searches on the google I found the incredibly obscure yet highly useful site: money

Then I realized... "I don't need this junk mail." money

I used my mad google chops and found the Federal Trade Commission instructions for stopping unsolicited junk mail credit card offers. This page includes a number of steps to opt out of advertising abuse. The sad news about all this is that these blocks are temporary and even worse- in fine bureaucratic form- the time periods are not the same. This sadness is offset a bit by the astonishing fact, that the time periods are listed! Well except for when they are not... money

- Call 1-888-5-OPTOUT (567-8688) 2 years

- Write the three major credit bureaus Equifax, Experian, and TransUnion and tell them to quit sharing your info with advertisers (click the link for addresses and a form letter to use). Not clear how long this will last.

- The site to stop telemarketers is also included: www.donotcall.gov 5 years

- And lastly, the Direct Marketing Association’s information is included so you can contact them and tell them to leave you alone. 5 years

0 comments Posted by Healtyboy at 6:31 AM

Labels: Resources

IRA Rollovers and Roth IRAs

Sue Stevens finished her series of articles on IRAs and talked about Rollover IRAs and I learned something new! I had no idea that legislation was passed to allow people to take 401(k)s or 403(b)s and roll them directly into a Roth IRA- starting in 2008. I have 403(b) money in an old account and have pondered rolling it into an IRA and then converting that to a Roth, but that always seemed like a hassle- so I am interested to find out more about this. money

Basically if you have a 401(k) or 403(b) plan and leave the company you are contributing to the plan through, you usually have three options. money

- Cash it out and pay penalties and taxes (don't do it).

- Stop contributing, but leave it alone (some 401(k)s may not allow this)

- Roll it into a rollover (traditional) IRA and as of 2008, into a rollover (Roth) IRA

There are other factors to consider when making this decision- but direct to Roth rollovers and thinking about access before 59 1/2 are good issues to be aware of. money

0 comments Posted by Healtyboy at 6:30 AM

Labels: Retirement