I just invested $152,824.12. (Hypothetically)

As promised, I have invested $50,000 in the Wylie Portfolio, $50,000 in a portfolio of Vanguard Index funds, $50,000 in a portfolio of ETFs, and $2500 in the first Wylie fund of the Wylie Portfolio. By first fund, I mean the first fund I picked: NTIAX. The extra $324.12 comes from fees required for the ETF portfolio and the exact cost of each ETF position being a little more or less than $2500.

So we have a portfolio of assorted managed funds and a few index funds you can buy through etrade for no fees, a portfolio of Vanguard index funds that you can't buy through Etrade or Vanguard for any fee because each fund has a $3000 minimum. I only invested $2500 to make the comparison simple. We have a portfolio of ETFs you can buy through Etrade for $12.99 each. And we have a version of the mostly managed portfolio I will add to one fund per month.

The purchase dates for all these portfolios is the price as of closing on 5/1/07. So if you have your own portfolio you want to compare to these, go to morningstar and create your own portfolio and enter your purchase at the price from 5/1/07. It is easy to look up historical prices. One way to do this is to go to Yahoo Finance and look up your fund or stock and click the "Historical Prices" link.

So far, the Wylie Portfolio invested in just one fund is in the lead, up 1.44% and the entire Wylie Portfolio of 20 funds is up 1.09% compared to the Vanguard Portfolio which is up 1.02% and the ETFs which are up .46%. Note that Year to Date, the Wylie Portfolio is in last place:

Some of the ETFs have not been in existence since 1/1/07 so I am not going to put too much creed in that figure as it is not an equal comparison. I'm also not going to put much creed in performance of two days. We'll see how things look in a bit.

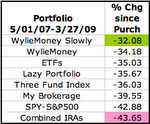

Here are the portfolios. Click the image for a larger view:

As promised, I have invested $50,000 in the Wylie Portfolio, $50,000 in a portfolio of Vanguard Index funds, $50,000 in a portfolio of ETFs, and $2500 in the first Wylie fund of the Wylie Portfolio. By first fund, I mean the first fund I picked: NTIAX. The extra $324.12 comes from fees required for the ETF portfolio and the exact cost of each ETF position being a little more or less than $2500.

So we have a portfolio of assorted managed funds and a few index funds you can buy through etrade for no fees, a portfolio of Vanguard index funds that you can't buy through Etrade or Vanguard for any fee because each fund has a $3000 minimum. I only invested $2500 to make the comparison simple. We have a portfolio of ETFs you can buy through Etrade for $12.99 each. And we have a version of the mostly managed portfolio I will add to one fund per month.

The purchase dates for all these portfolios is the price as of closing on 5/1/07. So if you have your own portfolio you want to compare to these, go to morningstar and create your own portfolio and enter your purchase at the price from 5/1/07. It is easy to look up historical prices. One way to do this is to go to Yahoo Finance and look up your fund or stock and click the "Historical Prices" link.

So far, the Wylie Portfolio invested in just one fund is in the lead, up 1.44% and the entire Wylie Portfolio of 20 funds is up 1.09% compared to the Vanguard Portfolio which is up 1.02% and the ETFs which are up .46%. Note that Year to Date, the Wylie Portfolio is in last place:

Some of the ETFs have not been in existence since 1/1/07 so I am not going to put too much creed in that figure as it is not an equal comparison. I'm also not going to put much creed in performance of two days. We'll see how things look in a bit.

Here are the portfolios. Click the image for a larger view:

0 comments:

Post a Comment