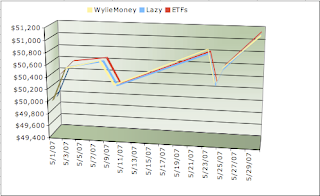

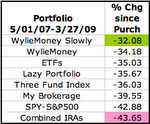

...but still remains in the lead!

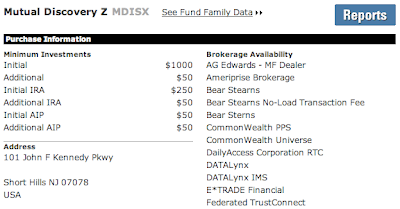

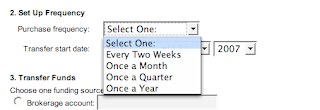

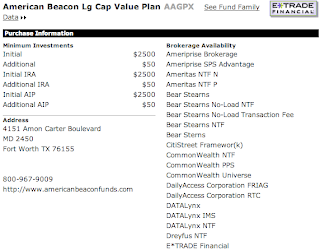

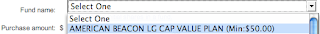

MONEYFirst of all, last week I went to Etrade's office in downtown Boston and explained my

issue to Justin, who forwarded it to the 'Mutual Fund Department' with a link to this site. So if you are here looking for the details of my issue, click

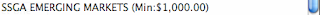

here or on the link in the upper right corner. Basically your site is not allowing me to set up an AIP plan with the additional minimum for AIP plans for the fund SSEMX

which is $100.

MONEYOn to the

competition!

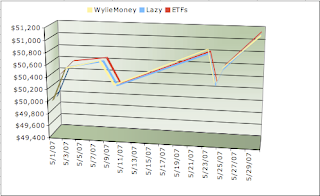

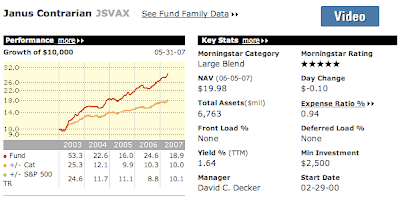

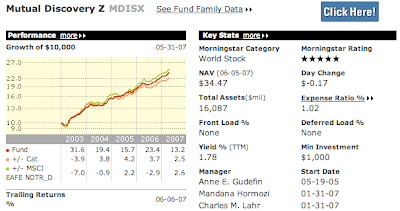

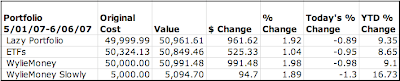

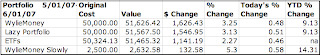

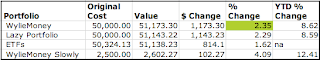

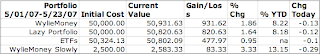

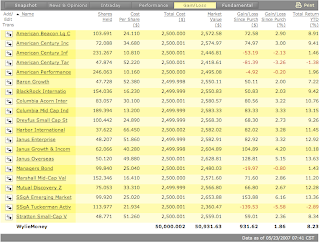

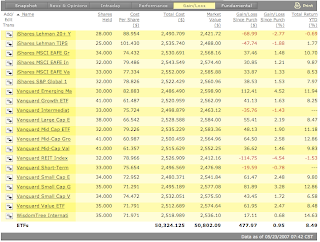

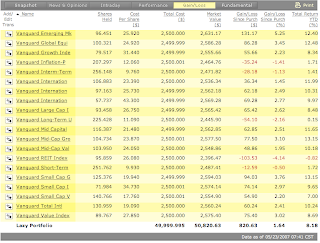

MONEYAs of today, the WylieMoney portfolio is still ahead, but not by much. I think today's slight under performance is due to some dabbling of a few of my fund managers in emerging markets which did poorly before American markets caught fire. The year to date totals for WylieMoney and

Lazy are remarkably close. I wonder how long that will last.

MONEY

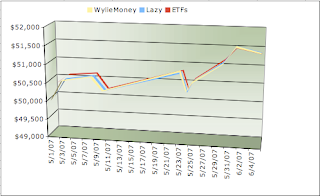

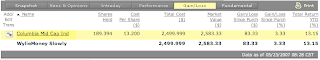

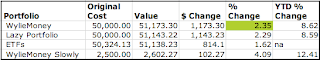

Anyway, I made a little chart of the the random dates that I have managed to document the total value of the accounts. This does not represent day to day performance as I only have totals from 8 days over the last month, but once I have several months of data, the graph should be loosely indicative of trends.

MONEY