Many financial analysts and advisor types claim market timing is a bad idea... I agree that if you look at an individual company that is performing well and is valued cheaply, buying it regardless of market trends, as a long term investment makes sense, but this does not necessarily apply to decisions about when to invest in mutual funds that focus on specific market sectors. If the fund broadly covers companies in a sector and growth in that sector slows or the sector goes out of favor with institutional investors, the stocks of those companies could decline and the fund could lose money. money

International markets have done really well recently, but is that any reason to not invest in them? Will emerging and international markets continue to trounce US markets? money

Beats me- I'll leave that to the experts. But moringstar has a nice summary of performance by category and if I were choosing a category (sector), I would take a look at how it has done and consider the likelihood of that trend continuing. money

I would not recommend basing an investment decision on this alone, but investing in a sector that has had a strong run does not make as much sense as investing in one that has not gained much over the last few years. money

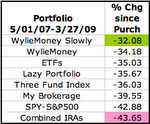

Which does make me rethink my IRA strategy. money

Should I invest in sectors that are not as represented in my portfolio to diversify and balance, even if those sectors have had a good run for a long time? I'll have to think about that one...

WYLIE MONEY SEARCH

MAVERICK MONEY MAKERS

If you are looking for a easy automated system, developed by millionaires, and proven to generate at least $354.97 per day from home, then Maverick Money Makers may be just what you're looking for!:click here for more information

If you are looking for a easy automated system, developed by millionaires, and proven to generate at least $354.97 per day from home, then Maverick Money Makers may be just what you're looking for!:click here for more information

Saturday, March 14, 2009

Market Timing and Mutual Funds

Posted by Healtyboy at 10:06 PM

Labels: Investing, Mutual Fund, Timing

Subscribe to:

Post Comments (Atom)

0 comments:

Post a Comment