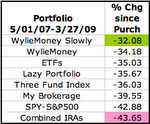

In part I we discussed the difficulties involved in choosing when to invest. Now I will talk about a few strategies for timing investments in mutual funds. These strategies may be no better than reading the almanac or having a blindfolded monkey throw darts at a list of stocks. Regardless of whether these strategies are better than monkey darts, they provide me with an approach that takes the emotion out of the decision of when to invest which has its own value.

When everybody is selling and has been selling, it is often a good time to buy. Motley Fool wrote a nice article about this notion. Buying mutual funds on a dip is a little trickier than buying a stock on a dip. When you buy most mutual funds, you buy shares at the price of the fund as of 4 pm on the day you make the purchase. So if 3 pm comes around and the market category you are investing in is down 2% for the day, you can place a buy order and you will buy shares of a fund in that sector at a price close to 2% lower than had you bought them the day before. Of course the fund itself won’t be down 2% exactly unless it is an index fund, and even then it won’t be the exact same, but typically if the category is down, the fund will be down. Now there is nothing to say the market sector won't go down another 2% or more the next day, but if you are going to buy, buying at a slightly lower price than the day before seems like a good idea to me. My sense is that when sell-offs happen, momentum often drags good companies down with the bad so if your fund manager is making good picks and the value of the fund takes a hit from some panic selling it is a good time to buy.

Tip one: Invest on a dip.

Another concept is: money moves from sector to sector as certain kinds of companies go in and out of favor among traders. For the most part, I am not looking into ‘sectors’ with the hypothetical portfolio I am putting together on this site. Recently, Financial, Technology, and Health sectors have lagged behind Natural Resources, Utilities and until recently, Real Estate which have been on fire.

I have been choosing funds for the Wylie portfolio among Growth and Value businesses across companies of all sizes. But even in these ‘categories’, some go up while others go down. So if you have money to invest, it is not a bad idea to see which category has lagged behind. If you invest in sectors, the same concept applies.

One easy way to find out how sectors or categories are performing is to use Morningstar's free list of performance by category. This list mixes in what I am calling categories and sectors. There are many ways to build diverse portfolios, but you gotta pick one if you are going to get started and I picked categories (Large Growth, etc.).

Tip two: Invest in categories that are lagging behind.

Another thing to consider is that stock prices are generally based on some combination of how a company is doing and how investors think the company will do in the future. But investors use all sorts of different formulas to determine how profitable a company really is and to guess what impacts new products or ideas will really have. The way accounts 'expense' stock options as part of employee compensation, how the iPhone will boost or detract from Apple’s free cash flow... who knows? Part of why I am looking at mutual funds is I do not have enough time to analyze or stay on top of enough individual companies to build a good diverse portfolio.

Morningstar, pays lots of people to try and do this though, and they have a specific approach to calculating what they call Fair Value Estimates. Then they take these values and track indexes to determine if the markets those indexes track are fairly valued. Finally, they share this information for free. In part I, we looked back and saw that not buying because stocks are overvalued can lead to missed gains, but when the bubble popped, extremely high valuations were a sign that some heeded ahead of time and they were happy they did. I wish Morningstar's tool actually tracked valuations by category and included international companies as well but you get what you pay for I guess.

Tip three: Invest when markets are undervalued.

So we have three gauges to help identify good times to invest.

The general concept is, when the US market is broadly undervalued, identify which market categories specifically have underperformed and on a specific day when the market is down a good bit, buy.

No one tip or even all three will enable you to identify the perfect time to invest. Part III of this series will look at how to hypothetically jump into a Wylie portfolio like the one I am putting together on this site, using these three general ideas in a systemic way.

WYLIE MONEY SEARCH

MAVERICK MONEY MAKERS

If you are looking for a easy automated system, developed by millionaires, and proven to generate at least $354.97 per day from home, then Maverick Money Makers may be just what you're looking for!:click here for more information

If you are looking for a easy automated system, developed by millionaires, and proven to generate at least $354.97 per day from home, then Maverick Money Makers may be just what you're looking for!:click here for more information

Monday, March 30, 2009

When to buy Mutual Funds Part II

Subscribe to:

Post Comments (Atom)

0 comments:

Post a Comment