My pick: JAGIX Janus Growth and Income Fund

Some of my first picks have been less popular categories, but searching for a Large Cap Growth fund, I found 96 options with no loads and no transaction costs available through etrade. money

First, I sorted the options by 3 year performance. Then I looked at expenses and turnover. The average expenses for this category run 1.37% and the average turnover is 83.76%. Since I had so many choices, I was able to find options with lower expenses and turnover among the best performers when I went through the first 15 funds listed. During my first look at these I ruled out several funds including any with expenses over 1.20%: money

JAMES EQUITY (JALCX) and JANUS ADVISER GROWTH & INCOME S (JADGX) are too expensive with 1.50% and 1.22% expense ratios respectively. money

FIDELITY ADVISOR NEW INSIGHTS INSTL (FINSX) and JANUS TWENTY (JAVLX) are closed to new investors. money

MARSICO 21ST CENTURY (MXXIX) has way too much turnover at 175% for a taxable account and is too expensive with a 1.39% expense ratio. money

GENERATION WAVE GROWTH (GWGFX) 1.50% expense ratio is too high. money

WELLS FARGO ADVTG CAPITAL GROWTH INV (SLGIX) is too expensive at 1.42%.

TURNER CORE GROWTH I (TTMEX) has very low 0.59% expenses but too much turnover at 136%. money

Six of the first 15 funds are worth considering:

JANUS ADVISER FORTY S (JARTX) has a 1.18% expense ratio which is higher than some of the others but not too high. money

TRANSAMERICA PREMIER EQUITY INV (TEQUX) looks interesting with a below average 1.09% expense ratio and 32%turnover rate. money

EXCELSIOR LARGE CAP GROWTH (UMLGX) has below average expenses at 1.10% and has a low 24% turnover. money

JANUS GROWTH & INCOME (JAGIX) has very low expenses at 0.87% and below average 38% turnover. money

WESTCORE BLUE CHIP (WTMVX) has 1.11% expenses and 50% turnover

SIT LARGE CAP GROWTH (SNIGX) has low 1.00% expense ratio and 24% turnover.

T ROWE PRICE GROWTH STOCK ADV (TRSAX) has low expenses at 0.94% and 36% turnover. money

Looming at these six funds, the performance of some has been better recently some better over the long term. Chasing near term performance is never a good idea, so I sort by lowest expenses:

TRSAX has performed better than JAGIX recently, but JAGIX has a better 3 year performance record. Either fund would work. TRSAX looks like it tracks Large cap domestic indexes more closely. JAGIX has a Large Cap Domestic base but also holds international funds and some stock in smaller companies. Janus is known for being a more aggressive fund company in general. This hurt investors who bought Janus funds at the peak of the market in 2000. But for the purposes of this hypothetical portfolio- with a plan to invest regularly, a more aggressive fund, with lower expenses, is my choice. money

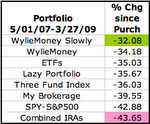

WYLIE MONEY SEARCH

MAVERICK MONEY MAKERS

If you are looking for a easy automated system, developed by millionaires, and proven to generate at least $354.97 per day from home, then Maverick Money Makers may be just what you're looking for!:click here for more information

If you are looking for a easy automated system, developed by millionaires, and proven to generate at least $354.97 per day from home, then Maverick Money Makers may be just what you're looking for!:click here for more information

Tuesday, March 10, 2009

Non-Ret: Large Cap Growth

Posted by Healtyboy at 9:37 AM

Labels: Mutual Fund, Non-Retirement

Subscribe to:

Post Comments (Atom)

0 comments:

Post a Comment