In Part I we pondered the issues involved in deciding when to invest. In Part II we looked at a few tools and discussed some strategies to help gauge what shape the market is in. In part III we will work out a system to invest in the wylie hypothetical portfolio of 20 mutual funds.

To make the initial investment in the 20 funds I am picking, I would need $50,000. Many of these funds have $2500 initial investments, so I plan to make a hypothetical initial investment of $2500 across the board to keep things simple. Hey- it is only hypothetical money, after all.

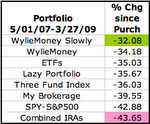

If I was investing my hypothetical $50,000 and it was mid to late 2002, I would invest it all right away. Indeed, in 2002, I did invest the savings I had set aside to invest, as soon as I was sure I could leave it invested for a while. I wish I had $50,000 real dollars to invest in a portfolio like this at that time as many of these funds are way up over the last 5 years.

That said, I do not think today is a terrible time to invest but also it does not feel like the best time either. So to invest my $50,000 hypothetical dollars, I will invest $2500 in one fund at a time, once every month. This will spread my initial investments out over almost two years.

I also plan to invest all $50,000 in a separate portfolio, right away and I will see after the fact which approach was better.

Once I make the minimum initial purchase for each fund I will add $100 to each fund or $2000 per month into the entire portfolio. And I will keep an eye on the market and the first day each month that markets are down about 1%, I will make that subsequent purchase. Etrade actually lets me do this for now. The $100 minimum for additional investment into mutual funds is often listed as being contingent on setting up an Automatic Purchase Plan, but I have found that I can pick the day myself and make the purchase manually for mutual funds I own (which again is not all 20 of these!).

I will invest these funds in two hypothetical portfolios in Morningstar's portfolio tool, unless I find a better one by next week.

Now some of you are saying- "I do not have $50,000 or $2000 extra a month to invest so what do I care" I tried to pick funds in a specific order such that one could invest any amount between $10k and $50k and still employ a system like this one. For example one could put $10,000 in a wylie portfolio of 4 funds. Then, if one could save $400 hypothetical dollars every month or every other month or even every quarter, one could still use this system- though there is no guarantee you won't lose gobs of money so do your own research and take responsibility for your own investments!

I'll try and work out how hypothetical portfolios of fewer funds perform as well.

Finally, I want to compare my list of Etrade's best no load no fee mutual funds (in my opinion!) against a similar portfolio consisting of Vanguard index funds and also against a portfolio of ETFs.

If all the work I did picking mutual funds does not lead to a portfolio that outperforms what could be easily done with simple index tracking, that will be good for me to know when I do have $50,000 real dollars saved up after I stick with all our tips for living cheaply!

So to do this, I need to finish picking the 20 funds. I hope to set up the portfolios starting in May so expect a few more posts soon!

WYLIE MONEY SEARCH

MAVERICK MONEY MAKERS

If you are looking for a easy automated system, developed by millionaires, and proven to generate at least $354.97 per day from home, then Maverick Money Makers may be just what you're looking for!:click here for more information

If you are looking for a easy automated system, developed by millionaires, and proven to generate at least $354.97 per day from home, then Maverick Money Makers may be just what you're looking for!:click here for more information

Monday, March 30, 2009

When to buy Mutual Funds Part III

Posted by Healtyboy at 5:59 PM

Labels: Investing, Mutual Fund, Non-Retirement, Timing

Subscribe to:

Post Comments (Atom)

0 comments:

Post a Comment