My Pick: Harbor International HIINX

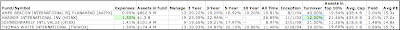

Selecting from mutual funds available through Etrade with no load or transaction fee and an initial $2500 investment or lower minimum and subsequent $100 or lower minimums, when looking for a Foreign, Large Cap Value fund, I have four options. Click the table below for a larger view: American Beacon International Planahead AAIPX is appealing because of it's low expenses. Indeed, I picked American Beacon Planahead as a good Domestic Large Cap Value fund. Harbor International has a much lower turnover which should help keep taxes down and has performed better than American Beacon. Thomas White has also performed better, but its expenses are higher and turnover is the same as American Beacon. money

American Beacon International Planahead AAIPX is appealing because of it's low expenses. Indeed, I picked American Beacon Planahead as a good Domestic Large Cap Value fund. Harbor International has a much lower turnover which should help keep taxes down and has performed better than American Beacon. Thomas White has also performed better, but its expenses are higher and turnover is the same as American Beacon. money

Upon further research, I discover that .25% of Harbor's expenses are what is known as 12b-1 fees. I think of these fees as marketing fees and they have gotten a lot of bad press in the last few years. After all, why should fund holders shoulder advertising costs for fund companies?

In particular Dustin Woodard wrote at length about 12b-1 fees and how he feels the way Etrade handles them is deceptive and bad. While I understand Dustin's point, I disagree with his conclusion. Etrade rebates fund owners 50% of these fees. So for anyone buying Harbor International via Etrade, the expense ratio you will pay is not 1.30%, it is closer to 1.18%. Dustin's point is that this encourages folks to buy funds with bad fees, but it does not make sense to me to pick a fund with 1.30% that does not charge 12b-1 funds versus one with 1.30% that does since I will pay less fees by choosing the one that includes the 12b-1 fee all other things being equal. Perhaps Dustin's concern is that most fund consumers won't understand how to research the other things- Loads, transaction fees, etc. In this case, with the rebate, the fees for Harbor International are much closer to those of American Beacon and the turnover is half as much. money

Actually, Morningstar reveals that Harbor's fees and turnover have both gone down even more since the beginning of the year. So due to slightly better performance, lower turnover and similar fees, I choose Harbor for this category. money

WYLIE MONEY SEARCH

MAVERICK MONEY MAKERS

If you are looking for a easy automated system, developed by millionaires, and proven to generate at least $354.97 per day from home, then Maverick Money Makers may be just what you're looking for!:click here for more information

If you are looking for a easy automated system, developed by millionaires, and proven to generate at least $354.97 per day from home, then Maverick Money Makers may be just what you're looking for!:click here for more information

Friday, March 20, 2009

Non-Retirement: Foreign Large Cap Value Mutual Fund

Posted by Healtyboy at 9:31 PM

Labels: International, Mutual Fund, Non-Retirement

Subscribe to:

Post Comments (Atom)

0 comments:

Post a Comment