My Pick: Baron Growth BGRFX

Searching for funds available from etrade for no transaction fee, I used the new screener tool to identify Small Cap Growth funds with lower than average turnover and expenses and sorted out the 5 best performing funds over the last few years. money

Expenses for Small Cap Funds average higher than Large Cap Funds so below average can include a ratio over 1% but there are cheaper options like Bridgeway Small Cap Growth which has low .81% expense ratio. Furthermore, I own this fund and am a big fan of manager John Montgomery. Just dig around Bridgeway's site for a glimpse at a rare approach to running a company. One example, salaries at Bridgeway are capped at 7 times the lowest salaried employee. You'd be hard pressed to find a non-profit that holds to that standard, much less an investment company... And the updates Bridgeway sends out for its funds are the most sensible updates I have read. Most managers give 'updates' that are half sales pitch in disguise (or not so disguised) and half regurgitation of the conventional wisdom of whatever the macroeconomic trend was over the last quarter. John talks about what has happened with his holdings and how his approach is doing- he tells it straight. If you are curious about what I mean go here and download the September 10 2006 quarterly report. money

More importantly, this fund has performed quite well since its inception, and even though it has lagged other funds in its category recently, I have confidence that this fund will do well in the long run. It uses a specific approach to picking funds that has not been rewarded recently, but by sticking with their approach the turn around should be fun to watch, even if it does not happen soon. The reason I am not picking it is that through etrade it has a $500 additional contribution minimum. This is frustrating because, Bridgeway itself has a $100 minimum and why etrade has upped this for this family of funds in particular escapes me. I confirmed Bridgeway's minimum and can confirm that they have great customer service, while trying to get anyone at etrade to respond with questions about this kind of thing can literally take months and seriously damage your calm. But that is a tale for another day.

The fund I am picking is curious because it came up as a Small Cap Growth fund and Morningstar, Yahoo finance, and Google finance label it Small Cap Growth but they all also label it Mid Cap Growth. Why do they flip flop? money

Here is yahoo's take: And here is google's:

And here is google's:

Morningstar has the same assessment but their graphic makes it clearer that this fund is right on the line between small and medium sized companies as far as the companies it invests in. My suspicion is that the style box uses a weighted average and the 'category' is not weighted- regardless you can see that about half the fund is invested in 'medium' sized companies and half is in 'small' sized companies. money

If etrade offered a no transaction fee growth fund that fit into the limits of this hypothetical portfolio that was significantly weighted in only small companies and had performed in line with the average small cap growth fund, I would likely pick it here, but no such fund is available. money

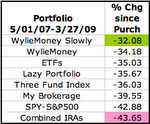

WYLIE MONEY SEARCH

MAVERICK MONEY MAKERS

If you are looking for a easy automated system, developed by millionaires, and proven to generate at least $354.97 per day from home, then Maverick Money Makers may be just what you're looking for!:click here for more information

If you are looking for a easy automated system, developed by millionaires, and proven to generate at least $354.97 per day from home, then Maverick Money Makers may be just what you're looking for!:click here for more information

Wednesday, March 18, 2009

Non-Ret: Small Cap Growth

Posted by Healtyboy at 5:34 PM

Labels: Mutual Fund, Non-Retirement

Subscribe to:

Post Comments (Atom)

0 comments:

Post a Comment